There are a number of ways to handle state and county tax on a Punchout Catalog.ƒš‚ The two most popular ways to handle tax are:

- On the PO

- On the Invoice

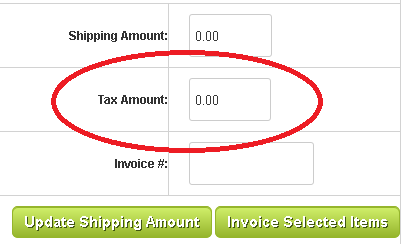

After a user shops in your Punchout Catalog, a purchase order is often issued electronically via cXML. In the electronic purchase order, tax can be sent as a single combined tax or as several individual types of tax. The most common taxes are state and county tax. When a purchase order is received by our system, we store all the tax values, transmit them via email and make them available on our portal administration system. When you are ready to send an electronic invoice the tax is pre-filled with the values your customer has sent, but you can change them if for example they do not apply to a particular order or location.

After a user shops in your Punchout Catalog, a purchase order is often issued electronically via cXML. In the electronic purchase order, tax can be sent as a single combined tax or as several individual types of tax. The most common taxes are state and county tax. When a purchase order is received by our system, we store all the tax values, transmit them via email and make them available on our portal administration system. When you are ready to send an electronic invoice the tax is pre-filled with the values your customer has sent, but you can change them if for example they do not apply to a particular order or location.

Even more common is when tax is simply sent on the invoice only. The user still shops in your Punchout Catalog, but when an electronic purchase order is sent there is no tax included. If the organization does need tax to be sent, you can send the tax on the invoice same as described above.

Either way, our invoicing system sends the tax as a proper tax mapped item so it will transmit directly into your buyers procurement system and avoid any delays in payment.