Introduction to Electronic Invoicing

Electronic invoicing (e-invoicing) is the digital exchange of invoice documents between a supplier and a buyer. This automated transfer of invoices is commonly used in eProcurement and online B2B transactions.

Unlike traditional paper invoices, e-invoices used in eProcurement are generated, sent, received, and processed electronically using cXML, XML, or EDI formatting. These methods eliminate the need for manual data entry and significantly enhance the accuracy and efficiency of the invoicing process.

The most common way to transmit e-invoices is through cXML or EDI. While XML can be used, it’s less common and mostly found in Oracle platforms.

In this blog, we will cover the benefits of electronic invoicing, key features, how it works, and the difference between EDI and cXML.

Benefits of Electronic Invoicing

Enhanced Efficiency:

- Automation: E-invoicing automates the invoice delivery process, removing the manual task of a physical file exchange. This reduces the time and effort needed to create, send, and receive invoices.

- Real-time Processing: Invoices are transmitted instantly with cXML or EDI. This allows for real-time processing and quicker payment cycles.

Cost Savings:

- Reduced Paper Use: E-invoicing eliminates the need for paper, postage, and storage, leading to significant cost savings.

- Lower Administrative Costs: Automation reduces the labor required for handling invoices, from data entry to error correction. This increased efficiency saves time and allows staff to focus on other projects, enhancing overall productivity.

Improved Accuracy:

- Error Reduction: Automated data entry reduces human error. This leads to more accurate invoices and fewer disputes down the line.

- Consistent Data: E-invoicing ensures consistent data formats. This facilitates easier integration with financial systems (ERP) and eProcurement platforms.

Environmental Benefits:

- Paperless Transactions: Reducing paper use contributes to environmental conservation and sustainability. It lowers the carbon footprint of businesses while conserving resources.

Enhanced Security:

- Secure Transmission: E-invoicing uses secure transmission protocols. This protects sensitive financial information during transactions.

- Audit Trails: Digital invoices create clear audit trails. This enhances transparency and accountability.

The Difference Between cXML and EDI Invoicing

Both cXML and EDI invoicing share the common goal of transmitting digital documents in a secure and standardized format between systems.

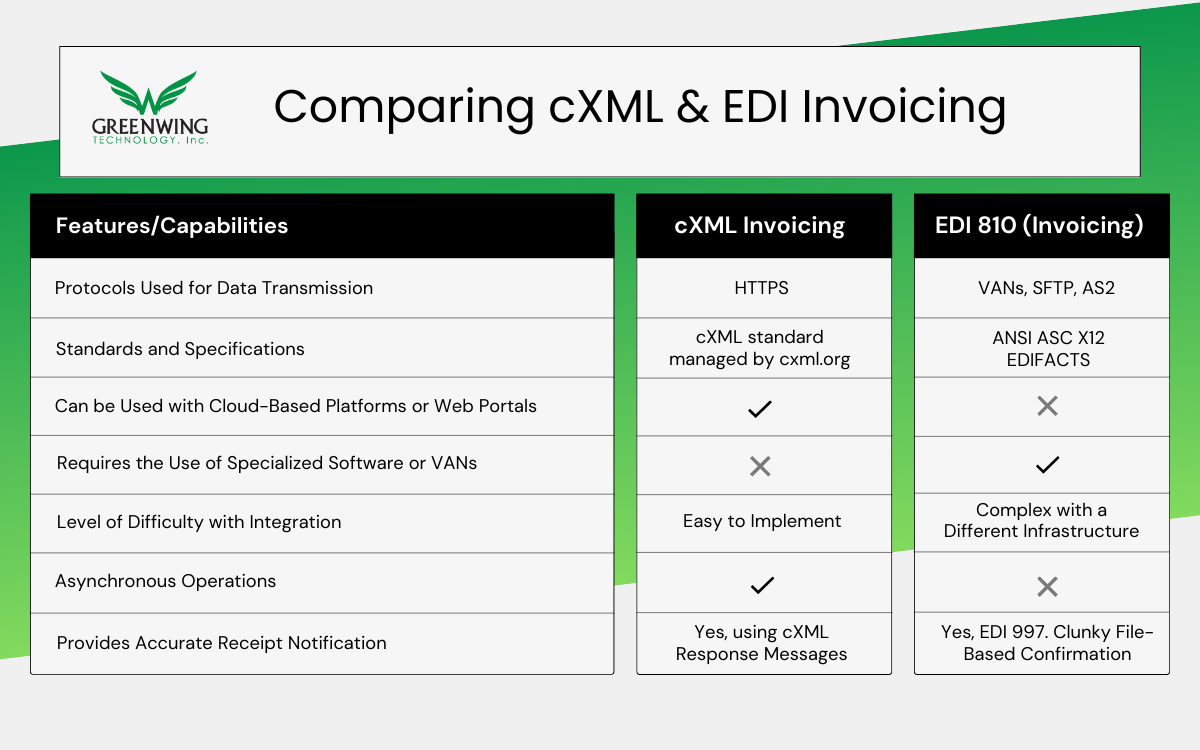

The table below highlights the unique differences between invoicing protocols, comparing cXML invoicing to EDI 810 invoicing. While other forms of EDI Invoicing exist (880, 894, and 210), we will focus on 810 as it’s more commonly used for different types of online transactions.

Supplier organizations regularly deploy these electronic transmission protocols to remove the hassle of manual invoicing processes.

cXML is the preferred and most-used method as it is more widely accepted, easier to map and configure between systems, and provides better reporting data that’s simple to track.

EDI 810 is more labor intensive and requires technical expertise due to its complex nature. While EDI can provide tracking and reporting data, it’s not as accurate as cXML and cannot be run in real time. Receipt confirmation of invoices comes in the form of a Functional Acknowledgement via EDI 997.

The Electronic Invoicing Process

Let’s break down the process of electronic invoicing:

When a business switches to a digital method of invoicing, a company must test this new functionality by having their customer build a cart, create a requisition, and send a purchase order.

Next, the supplier generates an invoice electronically to send to their customer. This newly developed digital invoicing method uses the supplier’s accounting or ERP system to generate and transmit it in a standardized electronic format using cXML or an EDI (Electronic Data Interchange) network. The invoice is securely received within the buyer’s financial system

Once the buyer’s system receives the invoice, it undergoes a validation process.

This step is crucial because it checks whether the invoice meets the required standards and contains all necessary information. If everything is in order, the invoice data is automatically entered into the buyer’s accounts payable system. This automation speeds up the approval process and minimizes manual intervention.

After validation and entry, the invoice is processed for payment according to the agreed terms. Payments can be made electronically via methods like ACH (Automated Clearing House) transfers or wire transfers, ensuring a smooth and swift transaction.

Finally, both parties keep digital records of the invoices. This is important as it ensures easy access for future reference and auditing purposes. Digital records also facilitate better tracking and management of financial documents.

Key Features of e-Invoicing Systems

Integration with ERP and Accounting Systems: One of the standout features of e-invoicing systems is its ability to integrate seamlessly with ERP and accounting systems. This integration ensures smooth data flow between different business processes, making it easier to manage financial transactions.

Standardized Formats: E-invoices are created in standardized formats like XML, UBL (Universal Business Language), and EDIFACT. These standardized formats ensure compatibility across different systems, making the invoicing process more streamlined and efficient.

Compliance with Legal and Tax Requirements: Electronic invoicing systems are designed to comply with legal and tax regulations in various jurisdictions. This ensures that invoices meet all statutory requirements, reducing the risk of non-compliance penalties.

Customizable Workflows: Many e-invoicing systems offer customizable workflows. This flexibility allows businesses to adjust the invoicing process to their specific needs, enhancing efficiency and effectiveness.

Reporting and Analytics: Advanced e-invoicing systems come with robust reporting and analytics capabilities. These tools provide valuable insights into invoicing and payment processes, helping businesses make informed decisions and optimize their operations.

Implementing E-Invoicing: Steps and Considerations

When implementing electronic invoicing, make sure to consider the following steps:

- Assess Current Processes:

- Evaluate your current invoicing processes. Identify areas where electronic invoicing can bring improvements.

- Choose the Right E-Invoicing Solution:

- Select an e-invoicing solution that fits your business needs. Consider factors such as integration capabilities, compliance features, and user-friendliness.

- Plan the Implementation:

- Develop a detailed implementation plan. Define the timeline, roles, and responsibilities for the project.

- Train Your Team:

- Provide training for your team on the new electronic invoicing system. This ensures that everyone understands how to use the system effectively.

- Test the System:

- Conduct thorough testing of the e-invoicing system before going live. This helps identify and resolve any issues.

- Go Live and Monitor:

- Launch the e-invoicing system. Monitor its performance and gather feedback from users to make any necessary adjustments.

Overcoming Challenges in Electronic Invoicing

Implementing e-invoicing is not without its challenges. Integration with existing systems can be tricky, but working closely with your IT team and Greenwing Technology can help overcome these hurdles.

Resistance to change is common in any organization. It’s important to thoroughly communicate the benefits of e-invoicing to your team and provide adequate training to ease the transition.

Data security is increasingly paramount when transacting online. Implement robust security measures to protect sensitive financial information and ensure secure transmission protocols.

Compliance is another area that requires organizational attention. Stay updated on legal and tax regulations to ensure your e-invoicing system meets all necessary standards.

Future Trends in E-Invoicing

Looking ahead, several trends are poised to shape the future of e-invoicing. More businesses are expected to adopt e-invoicing as they recognize its benefits and must keep up with demand. Government mandates in various countries are also driving adoption rates.

Advanced analytics capabilities will become more prevalent in e-invoicing systems, providing deeper insights into invoicing and payment processes.

Blockchain technology may also play a role, offering enhanced security and transparency for financial B2B transactions.

AI and machine learning technologies are likely to further increase automation, optimizing the e-invoicing process, improving accuracy, and enhancing efficiency.

Conclusion

Electronic invoicing is a powerful tool for businesses looking to enhance efficiency, reduce costs, and improve accuracy in their invoicing processes.

Companies can transform their invoicing and payment operations by understanding the benefits and differences of cXML and EDI solutions. Embracing e-invoicing is a step towards modernization and a strategic business move that can drive significant growth.

Watch our video to explain how electronic invoices (and purchase orders) work in an e-Procurement system. With punchout and punchout automation you can connect your system to Ariba, Coupa, Jaggaer, and more!